…

View Articles

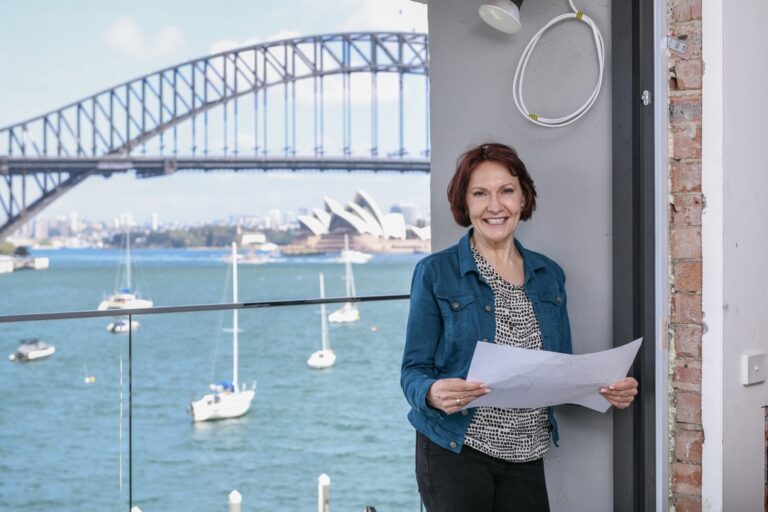

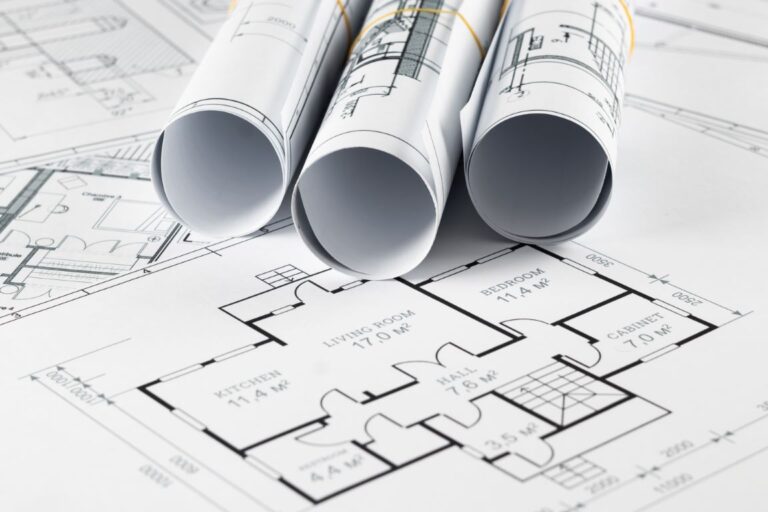

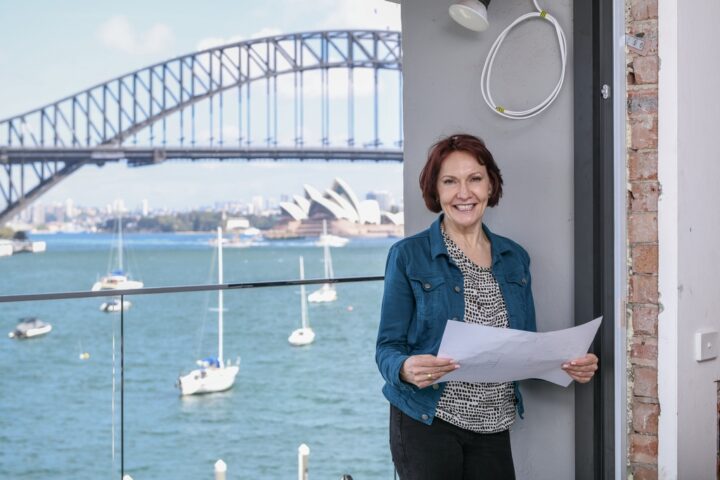

Renovation Cost Sydney 2024 – What You Need To Know

Is 2024 the year you wish to tackle your home renovation? Before you start, determine how much you need to budget for the complete makeover of your house.

Learn More Renovation Cost Sydney 2024 – What You Need To Know

Add Ensuite To Master Bedroom – Check Out How

You can add an extra bathroom to your home even if you are short on space. Our bathroom experts have created the smallest possible bathroom layout without it feeling tight.

Bathroom Tiles – What You Need To Know Before Purchasing

Choosing bathroom tiles can be overwhelming, with so many options available. Our team of bathroom experts can help you make the right choice for your space. But if you prefer to select the tiles on your own, our guide below can help you make an informed decision.

Learn More Bathroom Tiles – What You Need To Know Before Purchasing

Stay in touch

Leave your email address below to receive occasional tips on interior design and building design delivered straight to your inbox.

Copyright

Copyright © 2024 martinahayes.com.au

Website by Hubsite Builder