Sorry, no content matched your criteria.

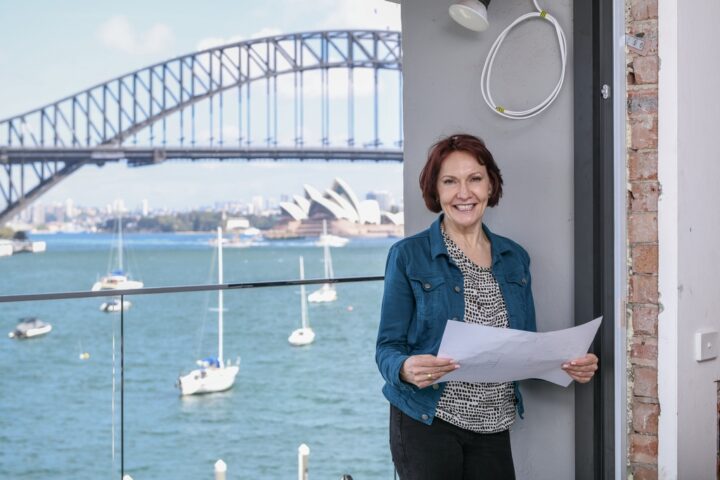

Renovation Cost Sydney 2024 – What You Need To Know

Is 2024 the year you wish to tackle your home renovation? Before you start, determine how much you need to budget for the complete makeover of your house.

Learn More Renovation Cost Sydney 2024 – What You Need To Know